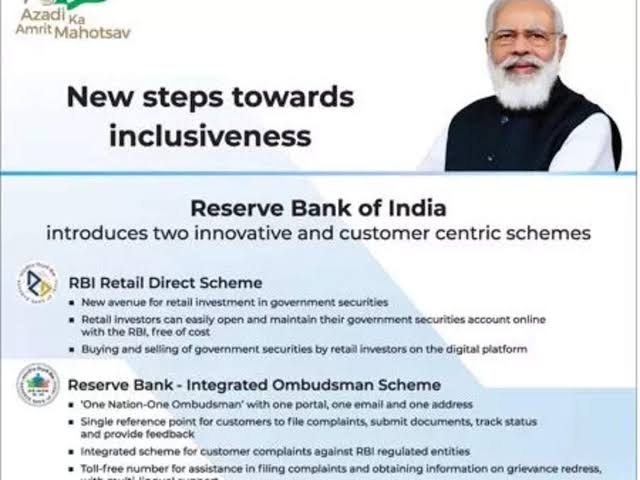

Prime Minister Narendra Modi launched two customer-centric initiatives from the Reserve Bank of India (RBI) on Friday. RBI retail direct scheme and integrated ombudsman scheme. This has opened India’s government bond market for individual investors.

“RBI has used technology and innovation to improve the efficiency of its services. The role of RBI development is focused on further deepening financial inclusion and embarking on people-centric initiatives. “RBI Governor Shaktikanta Das, who also attended the virtual launch of the scheme, said.

Das first highlighted this initiative in its February policy review and called it a “major structural reform.” In July, the central bank said investors would have access to primary auction bids as well as access to the central bank’s trading platform, the Traded Trading System-Order Matching Segment (NDS-OM).

So what exactly are these two schemes about? Let us explain.

RBI retail direct scheme

This scheme allows individual investors to buy and sell government bonds (G-Sec) online in both the primary and secondary markets. According to the details provided by RBI, these small investors are now able to invest in G-Sec by opening a Gold Security account at RBI. The account that is opened is called the Retail Direct Gilt Account (RDG).

According to a notice issued by RBI, individual investors can open RDG accounts such as Rupee Savings Bank accounts held in India, officially valid documents such as PAN cards and Aadhaar, and voter identification for KYC. increase. , A valid email ID and registered mobile phone number.

Participation and allocation of securities follow a non-competitive scheme. Only one offer per value is allowed. When the offer is submitted, the total amount to be paid will be displayed. Payments to the aggregator/reception office can be made from the linked bank account via the network banking service or UPI, so the funds will be deducted when the offer is submitted on the portal.

Registered investors can buy and sell government bonds through NDS-OM by accessing the secondary market trading link on the online portal.

You can pay for the purchase of government bonds by any of the following methods. Before the start of business hours or during the day, investors are required to transfer funds to a designated account of CCIL (Clearing Corporation of India NDS-OM). Based on the actual transfer/success message, a funding limit (purchase limit) will be granted to place a “purchase” order. At the end of the trading session, the excess funds found in the investor’s credit will be repaid. RBI integrated ombudsman scheme

This helps improve the complaint recovery mechanism for resolving customer complaints against RBI regulated entities. According to the PMO, this scheme is based on the “One Nation-One Ombudsman” with portals, emails, and addresses for clients to file complaints.

Customers can file complaints, file documents, track the status and provide feedback via a single email address. There is also a multilingual toll-free number that provides all relevant information regarding grievance handling.

This gives customers a single point of reference for complaining, submitting documents, tracking status, and providing feedback. The scheme has a multilingual toll-free number that provides all relevant information regarding grievance handling and support for complaints. Repairs remain free for bank customers and members.