The Centre is running various measures like insolvency and bankruptcy code and debt recovery tribunals to recover bad debts. On the same lines, the government is expecting to recover a sum of Rs 1.8 lakh crores worth of bad loans. The amount is expected to be recovered in the current fiscal year.

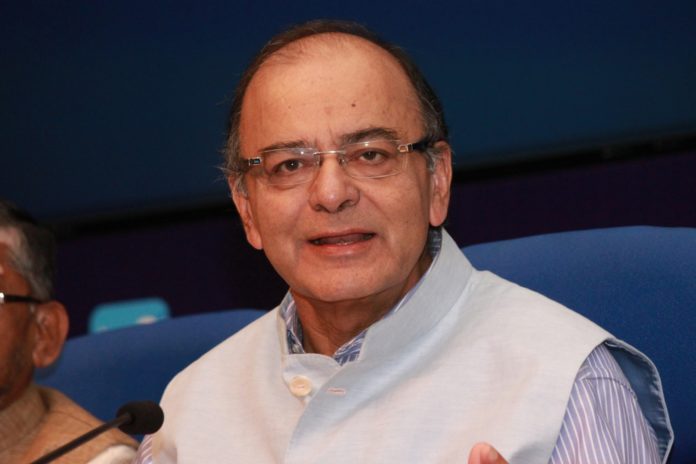

Finance Minister Arun Jaitley held a meeting with the public sector banks in Delhi. Various NPA cases are on the verge of recovery. As a result of the meeting, banks felt a sense of positivity in the regard of debt recovery.

As a matter of fact, there was a recovery of Rs. 75,000 crore in the last fiscal. Talking about the faults of Congress on the NPA crisis, Arun Jaitley said: “I can confidently say that we are on the right track to overcome what is traditionally described as legacy issues.”

There is a new lease of life amongst the bankers as the transformational schemes and policies will result in a speedy recovery of bad loans.

“After a prolonged period of several quarters when profits of banks went into provisioning, we saw net profit in the balance sheets of banks in the last quarter,” he added.

He also reflected that his government is on its toes and leveraging the phase of high consumption, high growth, NPA recoveries, and credit offtake. “On the basis of the last quarter and projections for the coming ones, the good news is that the NPAs are declining and the recoveries had picked up… credit growth has also picked up,” he added.

Jaitley was also not being hesitant to share the expectations of the government including that of demanding a revisit the Prompt Corrective Action (PCA) guidelines. Alongside, he also said that the banks are expecting the government to take cognizance of the capital requirements of these banks.