The Reserve Bank of India (RBI) increased its key lending rate by 40 basis points to 4.40 percent with immediate effect on Wednesday. The cash reserve ratio was also increased by 50 basis points by the central bank. The monetary policy committee (MPC) decided during an off-cycle meeting with the central board on May 2-4.

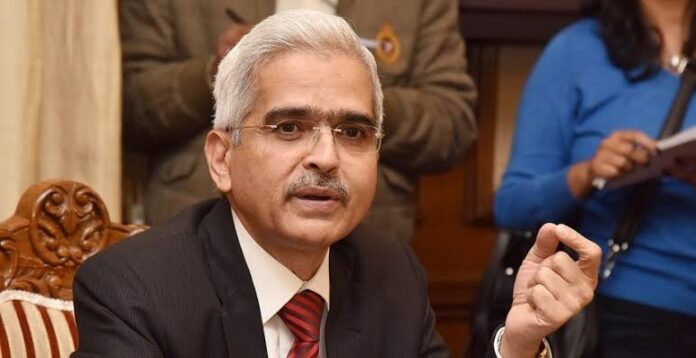

Rising inflation, geopolitical tensions, high crude oil prices, and global commodity shortages, according to RBI Governor Shaktikanta Das, have all had an impact on the Indian economy.

Geopolitical tensions, rising commodity prices, and weakening external demand, according to the RBI, pose global spillover risks to the economy.

“Today’s decision to raise the repo rate could be interpreted as a reversal of May 2020’s rate action.” We announced a withdrawal of accommodation last month. Mr Das stated, “Today’s action must be seen in the context of that action.”

“I’d like to emphasise that the monetary policy action aims to contain inflation spikes and re-anchor inflation expectations,” he said, adding that “high inflation is known to be detrimental to growth.”

This was the first hike in the policy rate since August 2018, raising borrowing costs for both businesses and individuals. The most recent surprise rate hike cancels out the Covid-supported off-cycle rate cut in May 2020.

The RBI also decided to keep its monetary policy accommodative while focusing on removing it in order to keep inflation in check in the future.

The RBI Governor stated in his speech that food inflation is expected to remain high as a result of spillovers from global wheat shortages affecting domestic wheat prices, despite adequate domestic supplies.

Edible oil prices may firm up as a result of the Russia-Ukraine conflict, as major producing countries have imposed export restrictions, he said.

For the third month in a row, retail inflation exceeded the upper end of the Reserve Bank of India’s target band of 2-4 per cent.