Adani Power shares cost has moved more than 70% in the last four exchange meetings. According to the Adani Power share value history, the Adani bunch stock had shut at ₹97.35 at NSE on third June 2021, which is at present exchanging at ₹166.90 (at 10:07 AM) — giving more than 70% re-visitation of its investors. As per securities exchange specialists, this sharp ascent in Adani Power stock cost can be ascribed to the two significant reasons — its interests in environmentally friendly power energy starting worth purchasing and halfway installments got by the Rajasthan and Maharashtra governments that were long due. Aside from this, abrogation of the Adani Power delisting has likewise worked for the Adani Power share value rally.

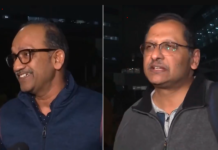

Featuring the crucial reasons supporting Adani Power share value rally Ravi Singhal, Vice Chairman at GCL Securities said, “Adani Power shares are ascending on two major reasons — its interests inefficient power energy starting worth purchasing and halfway installments made by the Rajasthan and Maharashtra governments that were long due.” He said that because of the rising petroleum and diesel costs, individuals are moving towards electric vehicles and the organization has as of late made interests in environmentally friendly power energy that has set off esteem purchasing among the drawn-out financial backers. Aside from this, the organization has gotten incomplete installment from the Rajasthan and Maharashtra state governments, which will prompt a decrease in the red of the organization. Singhal likewise said that scratch-off of Adani Power share cost delisting has supported stock value rally as crisp delisting would happen at a greater cost as we saw on account of Vedanta.

On specialized reasons that helped Adani Power’s stock value move more than 70% over the most recent four days Mudit Goel, Senior Research Analyst at SMC said, “Adani Power has given breakout at ₹100 and proceeded to break the solid obstacle of ₹150. The individuals who have possessions are encouraged to keep up following stop misfortune at ₹150 and book benefit at around ₹185 to ₹190.”

Talking on Adani Power share value focus in long haul time span Ravi Singhal of GCL Securities said, “The individuals who need to purchase Adani Power shares keeping long haul time-skyline, are encouraged to purchase the counter in ₹120 to Ra 150 territory (not at current levels) as some benefit booking is normal in the counter. In 6-8 months, Adani Power shares cost may go up to ₹255. Along these lines, in the event that somebody purchases Adani Power offers, the individual in question ought to keep up long haul viewpoint and rigorously keep up stop misfortune at ₹99 while purchasing the counter in the given reach.”