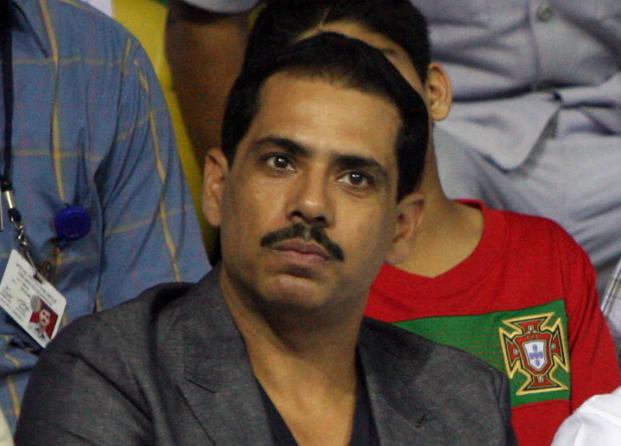

Congress President Rahul Gandhi’s brother-in-law Robert Vadra has been given a notice by Income Tax department for tax evasion. It is related to Vadra’s firm Sky Light Hospitality. As per the reports, the firm has been asked to pay Rs 25.8 crore in tax for the assessment year 2010-11. Son-in-law of Congress leader Sonia Gandhi, Robert Vadra, had managed to evade huge amount of tax. Know more.

This is the case of year 2010. On assessing the income of the firm for 2010-11, it is found that the actual income of the company for that year was nearly Rs 43 crore. However, it had been shown Rs 37 lakh in the books. After that, on revised income, the tax payable has been found Rs 25.8 crore.

But, this re-assessment was challenged by the firm by filing a petition but the Supreme Court dismissed the petition. The re-assessment notice was issued against the firm in connection with DLF-Sky Light Hospitality land deal.

Know how Vadra evade the tax

As per the tax department, Vadra’s firms are into buying and selling of land which is a pure business decision. But, according to tax declarations, these are found to be long term investments. While the former attracts a 30 per cent tax, the latter gets the benefit of indexation (of the property) as well as long term capital gains which is not more than 20 per cent. Now he will have to pay the difference which works out to Rs 25 crore including interest for the past seven years.

“There is no tax on capital gains on the sale of agricultural land if it is 8 km away from the urban limits of a city”.

Vadra’s case

In this case, the land deals were in Congress-ruled Haryana and Rajasthan. Here, Robert bought agricultural land which he sold to DLF with huge profits. In fact, in one of the deals, he had sold ₹ 7.9 crore agricultural land to ₹ 58 crore to DLF Hospitality. After the issue came under scrutiny, Vadra went to court that reassessment notice was issued to an entity named Skylight Hospitality Pvt Ltd which did not “exist on the date of issue of notice”. The company has become LLP by then.