Post Demonetisation, there have been a galaxy of guidelines and notifications regarding deposit and withdrawal. This engendered an intensified anguish in the minds and hearts of Indian masses. Nonetheless, the public has been cooperative in the clean-up drive which was pioneered by Prime Minister Shri Narendra Modi.

While the economy is apparently confronting stunted consumption rate, there is good news for a majority of Indians. Home, auto, personal and other loans are set to become cheaper. This would proliferate the consumption rate heavily.

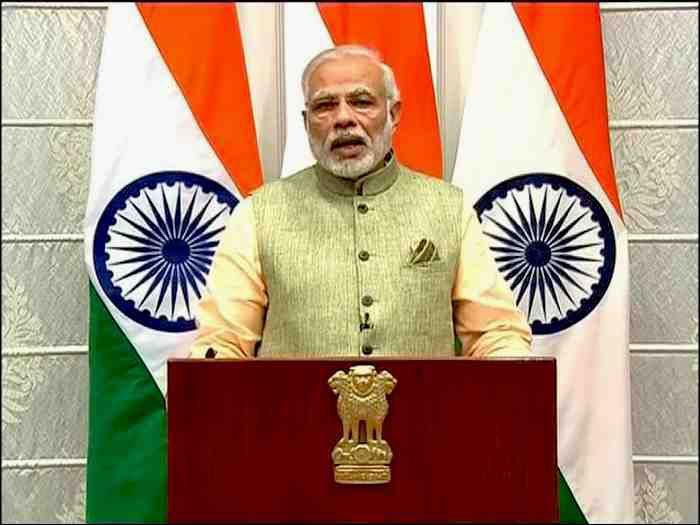

In Modi’s speech on the New Year eve, he supported the mega cash-clean up drive, bolstering the nuances of the whole movement and also laid out a slew of incentives clocking in more credit facilities for the poor and middle class.

Modi announced heavy subventions for home loans of up to Rs. 12 lakhs. Moreover, Modi heartily urged all banks to target the poor and middle-class in all their movements and activities. Riding high on the Prime Minister’s vision and desire, were three state banks namely the State Bank of India (SBI) and Punjab National Bank (PNB) and Union Bank of India. These banks cut their benchmark lending rates on Sunday.

On receiving heavy windfalls of money, post demonetisation, banks are in a formidable position to cut lending rates. Hopefully, all other banks are likely to follow counterparts’ footsteps and declare rate cuts too. This will engender home, auto, personal and other loans to become cheaper, thereby sprucing up consumption levels in the economy.

While, Union Bank of India reduced its MCLR by 65-90 basis points for loans of multiple time frames, SBI initiated a massive 90 basis points cut in its marginal cost of funds based lending rate (MCLR) for January across all maturities, PNB cut its MCLRs by 70 basis points for period of upto 3 year tenures.

Economic affairs secretary Shaktikanta Das tweeted,

Trend of interest rate reduction follows demonetisation. Banks have substantial quantum of low cost funds now.

— Shaktikanta Das (@DasShaktikanta) January 1, 2017