No matter how reckless we act on our money, at some point of time, everyone craves for some amount of financial stability. Every new choice made by us, leads to some amount of financial stability or frugality.

Investing with the intention of generating maximum returns comparatively is the general motive but the real intention should be to get some positive real returns. Aggressive return expectations leads to investment in equities, while if one wants regular income with little bit of risk involved, then debt-oriented investment option is the best.

But, in spite of all this, without taking any higher risk you can draw most of your investments with this. Investing via Balanced Fund is one simple and effective approach.

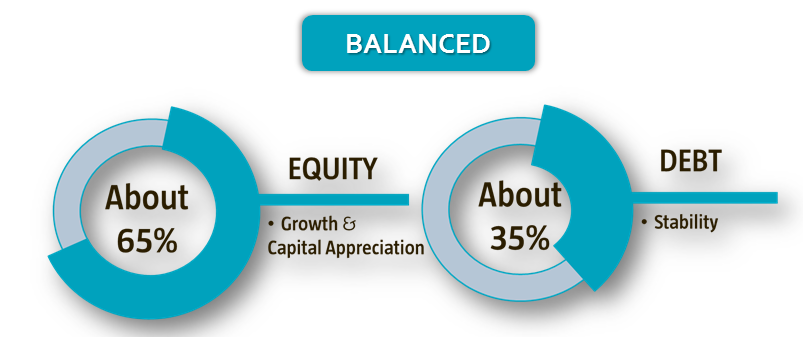

As the name itself suggests, balanced funds balance out the risk and take out more of returns. In this, you buy a mix conspired mix of equity stocks and short term bonds to make available both income and capital appreciation.

It Brings Tax Efficiency:

Buying and selling securities in fund reduces the tax liability to a great deal. 65% part of the investment is dedicated to equity allocation which is why the entire investment is taken as equity investment and selling them after 1 year, exempts you from taxable income holder.

It rebalances the things automatically:

Balanced funds asset allocation is kept at a strategic level and thus get you away from the tiresome task of managing Equity and Debt in separate potions.

Risk Return Balanced Out:

It leaves very small exposure portion for the fixed income securities because of its balanced approach between equity and debt schemes. Also, as the name suggests, this balanced approach stabilizes the risks involved with aggressive return yielding options.

With this year’s tax comforting budget, you get a chance to dive into the investment options to get you the maximum returns possible.