If you just curated an eye-popping idea last night for your start-up or you are in between talks with venture capitalists or angel investors for your new start-up. There is a brilliant news for you, which will make your day.

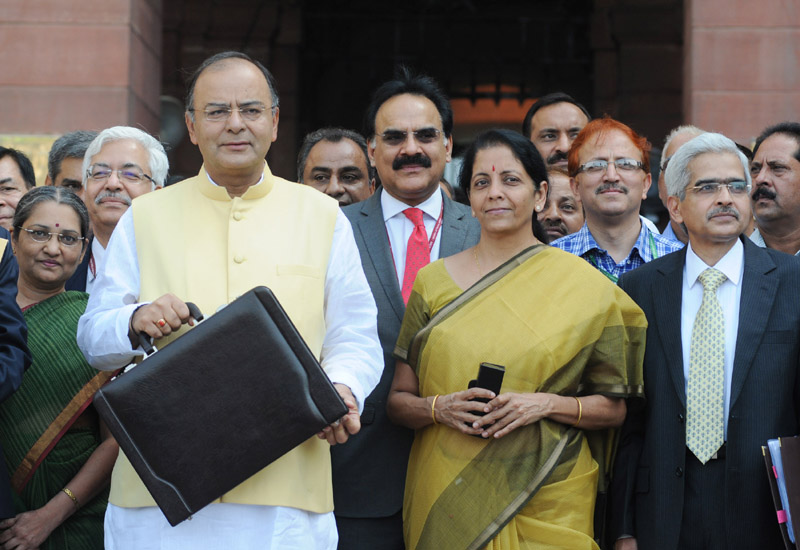

On Monday, Commerce and Industry Minister Nirmala Sitharaman indicated that start-ups may get additional tax benefits in the forthcoming budget, which is slated to come out on February 1.

If sources are to be believed, the ministry has already suggested the finance ministry to consider raising tax holiday for start-ups to 7 years from the current 3 years to bolster the emerging entrepreneurs.

“It makes tangible difference to a start-up, and in that some work has happened, more to be happening. Let’s see what this budget is going to offer,” Sitharam spelled out.

Tax related incentives and benefits will emerge only through the budget. Rumours are also abuzz that start-ups will be exempt from MAT (minimum alternate tax). MAT is a minimum tax which is imposed on companies on their gross income (without considering exemptions, rebates, etc.). The rate of MAT is 18.5%, which is also likely to be plummeted in the 2017-18 budget.

What’s more for start-ups? The government is also working upon removing legislative hurdles for all start-ups, thereby aiding the novice entrepreneurs in setting up their businesses.

To add to this, the government also plans to rope in local authorities to cushion the growth of start-up businesses.

The Commerce minister is certainly aware about how tax nuances affect significant decisions of many start-ups. She informed that all the suggestions of the entrepreneurs have been compiled by the ministry and have been conveyed to the finance ministry, to make a well-informed decision.